Navigating the Aloha State: A Comprehensive Guide to Hawaii State Taxes

January 16, 2024 Off By SublaidWelcome to the tropical paradise of Hawaii, where the sun, sand, and surf are not the only things that make this state unique. As residents and visitors alike bask in the beauty of the islands, it’s crucial to understand the ins and outs of Hawaii state taxes. In this comprehensive guide, we’ll explore everything you need to know about taxation in the Aloha State.

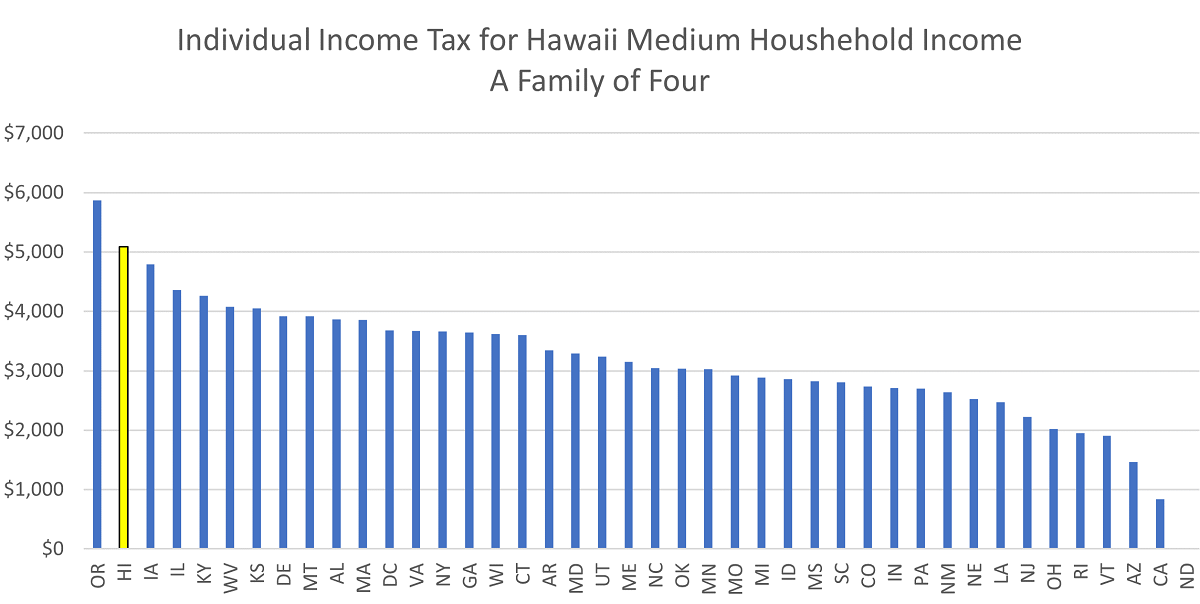

Understanding Hawaii’s Tax Structure: Hawaii imposes a state income tax on its residents, with a progressive rate ranging from 1.4% to 11%. Additionally thehawaiireporter the state has a general excise tax (GET), often considered a form of sales tax, which applies to almost all business activities. Exploring the nuances of these taxes is essential for residents and businesses to ensure compliance and financial planning.

Navigating Income Tax: Hawaii’s income tax system follows a progressive structure, with different tax rates for various income brackets. Understanding the deductions, credits, and exemptions available can significantly impact your overall tax liability. We’ll delve into the specifics of calculating and filing your Hawaii state income tax, offering tips to maximize savings and minimize surprises.

Decoding the General Excise Tax (GET): Unlike traditional sales taxes in other states, Hawaii’s General Excise Tax is levied on businesses at each stage of the production and distribution chain. This unique tax can have a broad impact on the cost of goods and services, affecting both businesses and consumers. We’ll break down how the GET works, its rates, and any exemptions that may apply.

Navigating Deductions and Credits: Hawaii offers various deductions and credits to help individuals and businesses lower their tax burden. From education credits to renewable energy incentives, we’ll explore the options available and guide you on how to make the most of these opportunities.

Tips for Tax Planning in Paradise: Whether you’re a resident or a business owner in Hawaii, effective tax planning is key to financial success. We’ll provide practical tips and strategies for minimizing your tax liability while staying compliant with Hawaii’s tax laws.

Staying Informed and Compliant: Tax laws are subject to change, and staying informed is crucial. We’ll discuss resources and updates to keep you abreast of any modifications to Hawaii’s tax code, ensuring you remain in compliance and well-prepared for tax season.

Conclusion: As you enjoy the breathtaking landscapes and vibrant culture of Hawaii, understanding the state’s tax system is essential for financial well-being. This guide aims to empower you with the knowledge needed to navigate Hawaii’s state taxes confidently, allowing you to focus on the beauty of the islands without any tax-related surprises.